May 2022 | Volume 23 No. 2

Cover Story

Money and the State

Money is different things to different people, none more so than economists and anthropologists. Economists often see money as an instrument that makes bartering in the market run smoother – it’s easier to trade dollars than lug around actual cows and bags of rice for exchange. But anthropologists and other social scientists increasingly argue that money precedes markets and in fact is created by states to create legitimacy and support their work.

Dr Oscar Sanchez-Sibony came across these arguments as he was delving into the economic history of the Soviet Union. He wanted to understand why, after taking power in 1917, the Bolsheviks signed their country up to the gold standard, to which major capitalist economies of the day had pegged their currencies to make them more interchangeable.

“The gold standard underpinned capitalism in the pre-World War One era and was an institution designed to protect financial interests and capital, so it seemed very surprising that anti-capitalist revolutionaries would join the gold standard. This was why I started to look into theories of money and how it works and gets created,” he said.

The theory that best fits the Soviet Union is that money is an instrument of the state to create social obligations that can be paid back in taxes. Money makes tax collection easier by obviating the need go to farms and take a share of produce to support state functions.

Rebuilding bonds

The Soviet Union was enlightening on this point because it did not have a stable currency until 1923 when they issued their own gold-backed rouble (chervonets) which, even then, did not take hold right away. For the first few years after 1917, the main forms of exchange were old imperial roubles and sacks of wheat – rather than moving actual sacks around, people recorded debts and payments in wheatsack terms. Acceptance of the Soviet rouble became important not only for practical reasons, but also because it meant the Soviet government could collect resources from people through taxes to rebuild the state and establish social cohesion.

“The Bolsheviks were unpopular, especially in the countryside, and they were trying to create a new state after one of the most destructive civil wars ever, which was followed by famine. They were trying to rebuild bonds back up within society. Money is such a great instrument for doing that, among other things, because it creates markets,” he said.

The adoption of the gold standard also had a political aim of showing bankers, investors, and ‘capital’ in general that the Bolsheviks were good financial stewards whose money would not suddenly devalue. This was necessary because the Soviets wanted to continue to export wheat and other commodities – collected from citizens even at gunpoint – to trade for industrial equipment and products.

But that aim hit a bumpy road when the gold standard started crumbling in the late 1920s. Countries were forced to devalue their currencies and they began to undercut each other, leading to disruptions to trade and ultimately, the Great Depression.

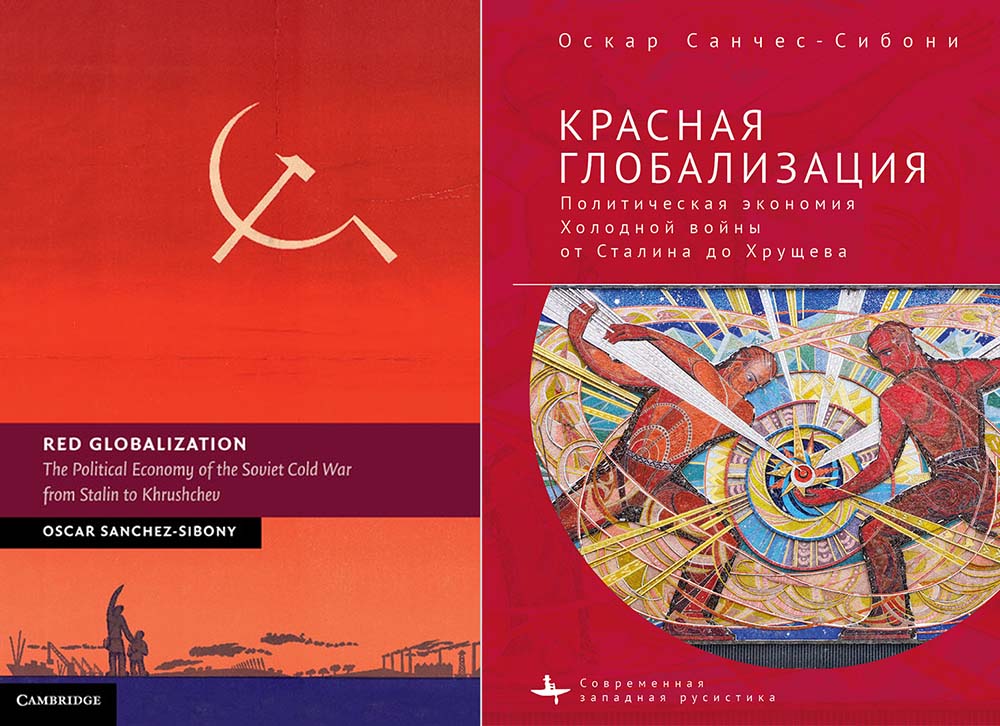

Red Globalization: The Political Economy of the Soviet Cold War from Stalin to Khrushchev (left) written by Dr Oscar Sanchez-Sibony and its recently translated Russian version (right).

A small return

The Soviets responded by collectivising farming to increase their acquisition of grain, a problem all governments faced at that time. Initially, 15 per cent of farms were targeted, but farmers were reluctant to sell to the state at low prices. When Joseph Stalin consolidated his leadership in the late 1920s, he ramped things up violently to the extent that the entire countryside was collectivised and famine and death ensued. It was a high price to pay for a small return.

“It turned out that even as they seized this grain, they still weren’t able to export it for industrial inputs,” Dr Sanchez-Sibony said, because all countries were trying to increase exports. “The Bolsheviks did that more than anybody by continuing to lower prices even at great pain to citizens.”

The Soviet Union was also one of the few countries to pay off all its debts during the Great Depression and never declare bankruptcy (though it had defaulted on the Tsar’s debts in 1918), which Dr Sanchez-Sibony said was because the Bolsheviks still wanted international capital. “If you take the view that money is just an instrumental thing with no meaning, then you miss understanding why they paid off their debts at such a huge cost.”

Dr Sanchez-Sibony noted that the state-linked view of money continues to have relevance today because money continues to serve the state. For instance, after the 2008 financial crisis, US policy was to print money and save banks and the banks of its allies. Earlier, after the 1997 Asian financial crisis, many governments built up large reserves of US dollars to protect against future economic collapse. “Vladimir Putin learned the lesson well. To a large extent, he has been able to withstand a lot of pressure from the US precisely because of the large reserves Russia built after 1998 on the back of oil and gas,” he said.

If you take the view that money is just an instrumental thing with no meaning, then you miss understanding why they paid off their debts at such a huge cost.

DR OSCAR SANCHEZ-SIBONY