May 2022 | Volume 23 No. 2

The Public Knows Best

Measuring the economic impacts of specific government policies, such as a new tax, is pretty straightforward: find the right variables and track them before, during and after the policy is announced. But trying to demonstrate a connection between overall government policy, economic growth and financial markets has been a far greater challenge because of the enormous number of variables involved. Dr Yang Liu of the HKU Business School and his colleagues have hit on a formula that may overcome that challenge and show how policy affects the overall economy and stock market, as well as exchange rates.

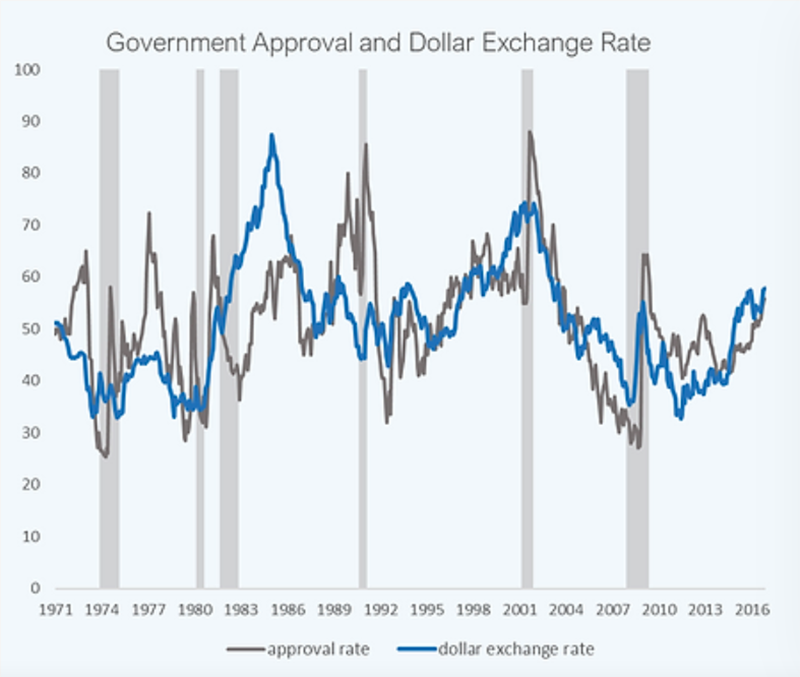

They looked at monthly public approval ratings of the US President and Congress from 1971 to 2019 and combined this with think tank assessments of government policies and the subsequent performance of the economy and stock market. They found that when approval was high, future growth rates of productivity, total output, consumption, investment, exports and imports, and government expenditures all increased over the following years.

“In other words, high approval ratings predict a persistent increase in future economic activity and an expansion in public outlays on intangible determinants of productivity and growth,” Dr Liu said. They also lead to a reduction in economic uncertainty and volatility.

These effects are not likely driven by sentiment such as confidence because while this can affect financial markets, it has less impact on the economy. Even when events of high emotion are factored in, such as 9/11 and Watergate, the results still hold.

“When we remove these single events, the results get even stronger, which means we are capturing the general, slow-moving idea of how people rate the government,” he said. The results are consistent whether during a Republican or Democratic presidency.

Measures of US government policy approval are strongly related to persistent fluctuations in the dollar exchange rates. High approval ratings further forecast a decline in the dollar risk premium, a persistent increase in economic growth, and a reduction in future economic volatility.

Investor responses

The measurement also translates to the stock market where higher approval ratings are correlated with stronger stock market valuations and a stronger bond market.

The scholars applied their method to another elusive question, that of exchange rates which did not appear to correlate with GDP, inflation, unemployment or other economic factors. The results showed exchange rates can be predicted based on government policy approval, which Dr Liu attributes to lower risk and uncertainty about the future.

“If I’m an investor and I am confident in the US policy and currency market, I will invest there without asking for a higher return. By comparison, if I want to invest in the Russian rouble, which is super volatile, I expect the rouble to appreciate in a big way in order to take that risk,” he said.

Dr Liu said their approach was useful in evaluating the impacts of policies that are otherwise difficult to measure, such as those on trade, labour and antitrust. It could also apply to some extent to other countries. While most places do not have the rich public survey data of the US, comparisons of think tank evaluations of other countries show a similar connection between high policy ratings and future economic performance.

Debt worries

Dr Liu also did a case study of the State of the Union Address, which is delivered each year by the US President, to show the impact of policy. On the day of the address, the stock market tends to increase about 0.3 per cent, or 30 basis points – compared with other days when it moves about three basis points – suggesting investors want a higher return for a higher risk. “In practice, people sell the stock before that day then once the address is reported on, they start buying stocks again and the return goes up,” he said. “Such a huge market reaction tells you how important policy can be.”

He has also looked at government debt, which can be a positive thing if it is not too high (about 50 per cent of GDP or less) because it enables governments to manage the macroeconomy and respond to emergencies. However, when debt levels get higher, there is uncertainty and risk over how the government will respond. “The higher risk means the future stock returns and future bond returns are going to be higher,” he said.

Currently, the US debt is about 100 per cent of GDP. Dr Liu said public approval of government policy is unlikely to counterbalance the impacts of debt because the government response to debt tends to be slow-moving. As things now stand, he is not hopeful for the future fiscal sustainability. “We are heading towards even higher debt. So the risk in fiscal policy will not end in our generation,” he said.

High approval ratings predict a persistent increase in future economic activity and an expansion in public outlays on intangible determinants of productivity and growth.

DR YANG LIU